Quick Easy Legit Ways to Make Money

You need cash at present, only payday is days or weeks in the distance. What do you do?

Panic and stress are natural reactions. Once those subside, you'll notice there are means to get your hands on money in a bustle, without falling casualty to scams.

Here are nineteen strategies to earn fast greenbacks today, plus some tips on how to cut costs, boost your income and build an emergency fund , then you don't find yourself scrambling for spare modify side by side time around.

1. Sell spare electronics

Yous can sell your old phone or tablet on sites such as Swappa and Gazelle, but to go greenbacks today, using an ecoATM kiosk is your best bet. Consider selling old MP3 players and laptops, too.

ii. Sell unused gift cards

Cardpool kiosks offer instant greenbacks for gift cards valued betwixt $fifteen and $1,000. You'll get slightly less there; the company pays up to 85% of the card's value at its kiosks, while it pays upwards to 92% if you sell through its website. You tin likewise go through an online gift card exchange like Souvenir Carte Granny, simply most take a few days considering you take to mail service the card and then wait for a check or direct deposit.

iii. Pawn something

As a way to borrow coin, pawnshop loans are not swell. But they're quick, and if you tin't repay the loan, the pawnshop simply keeps the item you lot used as collateral. That'south a lot better than ruined credit and calls from debt collectors. You can often sell outright to a pawnshop, too, instead of borrowing against an detail. Jewelry, musical instruments, firearms and up-to-date electronics fare best.

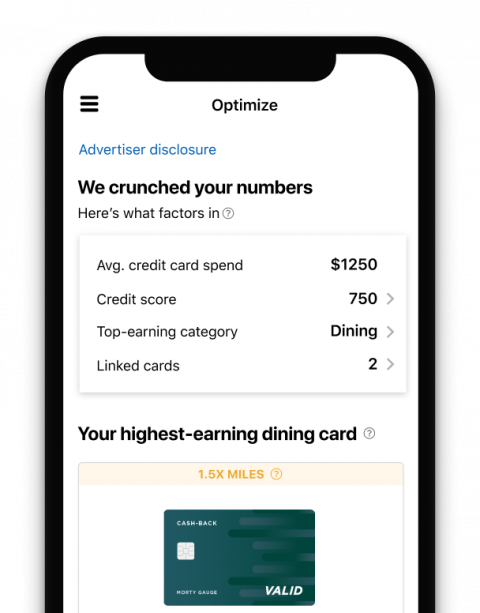

Spend smarter. Get rewarded.

Link your cards to see which ones will earn the near from your spending — and new ones to cheque out.

4. Work today for pay today

Searching for this phrase online turns up lots of results. We've researched 26 legitimate side jobs that can provide a quick income boost, ranging from driving passengers or packages to freelancing from home.

You can also effort the Craigslist jobs or gigs sections, which often have postings for short-term work in food service, housekeeping and full general labor.

5. Seek community loans and aid

Local community organizations may offer loans or short-term help to help with rent, utilities or other emergencies. NerdWallet has compiled a database of payday loan alternatives available to residents in nearly two dozen states. Local churches may make small loans at low rates. Community centers and nonprofit associations in your area may also offer pocket-size loans.

6. Enquire for forbearance on bills

Some creditors such as utilities and cable television companies don't charge interest on tardily payments, so find out whether they'll take delayed payments. Employ whatever money you save from not paying those bills to cover emergency needs. If you can't pay consumer debts such as auto loans or mortgages, explore your options with the lender first before turning to toxic high-charge per unit loans.

vii. Request a payroll advance

Ask your employer for a greenbacks advance on your pay, which usually doesn't toll you any fees and which y'all repay via payroll deduction. Some companies also offer low-cost loans to workers in crises. You also might consider Earnin , an app that offers workers advances that they repay in a lump sum on payday at no interest. Information technology does ask for a donation, though, and requires access to your bank account and work time sheets.

eight. Take a loan from your retirement account

You can take a loan on your 401(k) or individual retirement account, simply in that location are conditions. Y'all can borrow from your IRA once a year if you repay the money inside 60 days. If your employer allows 401(k) loans — not all practise — y'all typically tin can infringe as much as half your account remainder, upwards to $l,000, and y'all accept five years to repay it. Notwithstanding, if you don't make payments for 90 days, the loan is considered taxable income. And if y'all quit or lose your job, yous typically have to repay the 401(k) loan shortly thereafter.

nine. Borrow confronting life insurance

If y'all have a life insurance policy that has cash value, sometimes called permanent life insurance, y'all can borrow confronting it and have the rest of your life to repay it. If you lot don't repay, the insurance visitor subtracts the coin from the policy payout when you die. But you tin't borrow confronting a term life insurance policy, which is the more common type.

10. Apply a credit bill of fare cash accelerate

If yous have a credit card and the account is in good standing, a cash advance is a much less expensive option than a payday loan. You'll pay a fee, typically around v% of the amount yous infringe, plus interest, which tin can exist effectually xxx%.

11. Expect for a payday alternative loan

Some credit unions offer small-scale, short-term greenbacks advances known as payday culling loans . Federally chartered credit unions legally can't charge more than a 28% annual percentage charge per unit on PALs. That's not inexpensive, but it's much improve than payday loans, which take triple-digit APRs.

12. Accept out a personal loan

Some lenders can fund a personal loan in a day ; if you have skillful credit, you'll probably accept many choices. If your credit is a challenge, you'll need to find a lender that not simply delivers fast cash but also accepts poor credit. Rates for borrowers with bad credit from mainstream lenders top out at 36% Apr. You may observe other lenders offer fast funding without a credit bank check, simply you'll pay triple-digit interest rates. Don't fall for it.

13. Rent out a room

Sites like Airbnb aren't just for people who accept vacation homes to hire out when they're not using them. Many of the site'due south listings are for extra rooms — or fifty-fifty shared rooms — in the owner's house, meaning yous could stay put while bringing in some cash, particularly if you lot alive in a reasonably desirable area. Check local ordinances to make sure short-term rentals are immune.

Creating a list on the site is free, but there is a 3% service fee when a reservation is made. The visitor releases payment to the host 24 hours later the guests check in.

14. Moonlight as a canis familiaris sitter

Technology is on your side hither, also, with sites including Care.com and Rover , matching pet owners with dog sitters and walkers. You tin can choose to host the canis familiaris or stay at the owner'due south house (and — here's an idea — rent out your place through Airbnb while you're gone). Rates are betwixt $20 and $60 a night in most areas, though they tin skew higher or lower depending on the location and the amount of work involved. (Not a dog person? Run across other hobbies that make coin .)

15. Become a rideshare or delivery driver

These are jobs y'all tin can practise in the evenings or on weekends, using your own car and gas. Companies such as Uber and Lyft lucifer y'all with people willing to pay for a ride, and delivery services such every bit OrderUp and Postmates pay you to evangelize takeout and other items.

16. Cut your insurance premiums

One of the dingy secrets of the car insurance industry is that premiums for the aforementioned driver for the same coverage tin can vary by hundreds of dollars from company to company. Each insurer does its own math; that's why it pays to compare motorcar insurance quotes .

If you like your carrier, review the dozens of discounts it may take available. Y'all could become x% off or more for things like making good grades, completing defensive driving training or going at least three years without an accident.

The same is true with homeowners insurance . Shopping around tin save y'all 10% to 15%, as can discounts for things like having a domicile security system, staying merits-complimentary or being a nonsmoker. And many insurers offer discounts for buying both car and homeowners or renters policies with them.

17. Consolidate your debt

If you lot're struggling to keep upwardly with multiple debt payments, you may be able to consolidate those balances — from credit cards, medical bills, shop financing or other charges — and lower your payments with a personal loan . Some lenders can fund the loan within a 24-hour interval. Refinancing $5,000 worth of debt from a 10% interest charge per unit to five% could salvage y'all more than $800 in involvement if you demand to carry the balance for at to the lowest degree 4 years.

If you have skilful credit, you lot tin can do a balance transfer of high-interest credit card debt onto a new menu with a 0% introductory interest charge per unit. Make sure you tin pay off the balance before the rate balloons at the stop of the introductory flow.

18. Refinance your educatee loans

Borrowers are benefiting from low interest rates and a competitive private student loan refinancing market, and refinancing options are available for people with a range of credit scores. It's worth checking into whether a refinance could save you lot money — specially when the average borrower through NerdWallet's refi platform can save more than than $11,000.

nineteen. Change your prison cell phone plan

If y'all value money in your pocket over buying a new fancy phone, look into cell phone providers that offering rock-bottom rates. FreedomPop offers basic voice and data service for gratuitous. The take hold of with these services is you frequently take to buy a telephone outright or bring your own. So maybe yous don't desire to sell your one-time phone quite yet. You can discover a prepaid cell phone programme for $30 a month or less likewise.

4 fast-greenbacks sources to avoid

Payday loans: Payday loans are short-term loans that are made to people who have a source of income and a depository financial institution account and that are repaid in a lump sum. Your credit isn't a factor, only if yous already have outstanding payday loans, you may not exist able to get another i. Interest is usually expressed equally a "fee" — $15 per $100 borrowed is typical. Only that can be a trap: Borrowers typically have the option to pay another fee instead of settling the loan, and over time, those fees add up. A typical $15 fee on a two-week loan amounts to nearly 400% interest on an annual basis.

Payday installment loans: Available at stores and online, these payday installment loans stretch repayment terms to equally long as three years. You don't need skillful credit; the products often are advertised every bit no-credit-check installment loans . Just y'all typically must meet the requirements of a payday loan: a paycheck and a bank account. Interest charges mount apace: A $2,000, 3-year loan at 400% Apr will finish up costing over $16,000.

Auto championship loans: These short-term loans — in places where they're legal — require you to hand over the title to your vehicle every bit collateral for the debt. They're ofttimes compared to payday loans, and the interest rates are comparable, simply they can exist even worse: If you don't repay, the lender can seize your car.

Credit-building payday loans: Most payday lenders don't report on-time payments to the big credit bureaus, which would assist your credit scores. Some lenders do, and they as well reduce interest rates on subsequent loans to reverberate improved credit. Oportun, Rise and Fig Loans all offer installment loans at a lower cost than a payday outlet — just their rates are all the same many times those of mainstream lenders. We don't recommend these loans unless the only other pick is a traditional payday loan.

Looking for more coin?

You lot may need more help if your current income isn't covering basic expenses, similar utilities. Learn virtually means to save on a tight upkeep , including getting support and negotiating with service providers.

Source: https://www.nerdwallet.com/article/finance/money-legitimate-ways-quick-cash

0 Response to "Quick Easy Legit Ways to Make Money"

Enregistrer un commentaire